Cobalt Prices Dip: Understanding the Market Shift

Cobalt, a vital component in batteries and various electronic devices, has recently seen a notable decline in prices within China. This shift comes on the heels of significant announcements from the Democratic Republic of Congo (DRC), which holds a commanding position in global cobalt production. Let’s delve into the factors contributing to this development and what it might mean for the industry.

The DRC’s Announcement

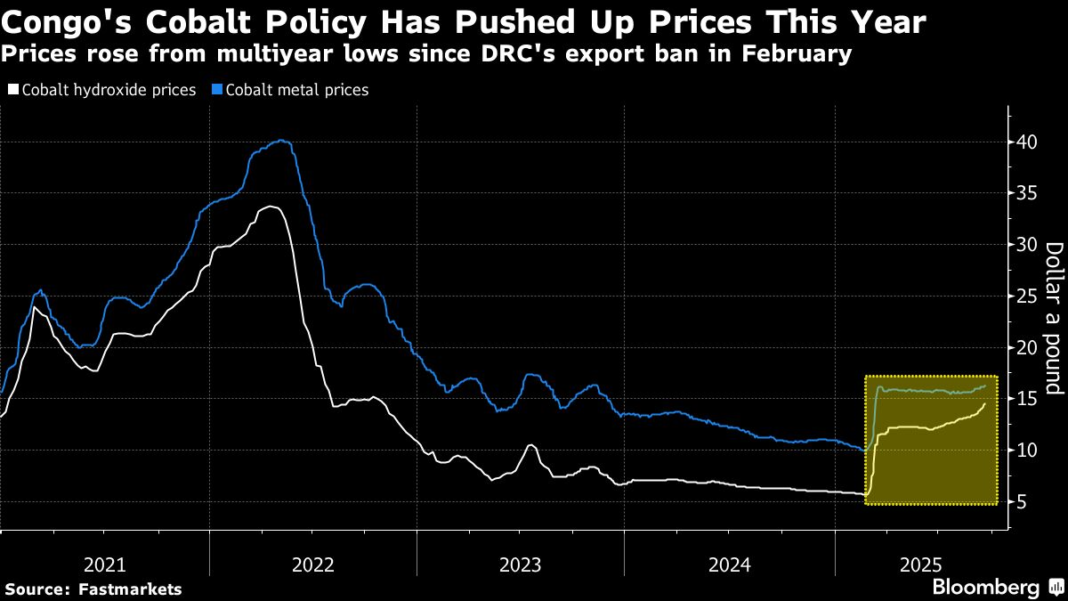

Over the weekend, the DRC, the largest producer of cobalt worldwide, revealed plans to replace a long-standing ban on cobalt shipments with new export quotas. This decision marks a significant shift in policy, as the previous ban was introduced to control illegal mining practices and ensure better regulation of the cobalt trade. The DRC’s announcement signals a critical change in how it intends to manage its abundant natural resources, aiming for a balance between economic gain and responsible mining practices.

Understanding Export Quotas

Export quotas are government-imposed limits on the quantity of a commodity that can be sold abroad. By instituting these quotas, the DRC aims to regulate the outflow of cobalt more effectively, ensuring that a portion of this precious resource remains within the country. The intention is to bolster local industries, create jobs, and drive economic development. However, this sudden adjustment could also mean fluctuating supply levels in the international market, something that often contributes to price shifts.

Impact on Global Cobalt Prices

The immediate reaction to the DRC’s announcement was a decline in cobalt prices in China, a significant market for this essential metal. Traders and investors typically respond to regulatory news with caution, especially concerning commodities that are heavily influenced by geopolitical factors. Lower prices often reflect an anticipated decrease in demand or an oversupply in the market, but in this case, it can also be interpreted as a sign of market adjustment rather than weakness.

Supply and Demand Dynamics

Cobalt’s pricing is predominantly influenced by the intricate dance of supply and demand. The introduction of export quotas might initially signal reduced availability for international buyers, but the clarity of regulations can also foster a more stable trading environment in the long run. Stakeholders in the battery production industry, including electric vehicle (EV) manufacturers, are keenly monitoring these developments. As EV demand surges globally, the strategic supply chain management of cobalt resources will be critical for maintaining production levels.

Environmental and Ethical Considerations

The DRC’s push for better regulation also comes amidst growing scrutiny over the environmental and ethical implications of cobalt mining. Cobalt is often extracted in conditions that raise human rights concerns, particularly regarding child labor and unsafe mining practices. The intention behind export quotas may help the DRC manage these issues more effectively, ensuring that mining practices improve while also enabling the country to maximize its wealth from natural resources.

What’s Next for Investors?

For investors, the current climate surrounding cobalt is a blend of opportunity and caution. The long-term prospects for cobalt remain robust, driven largely by the EV boom and the push for renewable energy technologies. However, the fluctuating price and complex regulatory environment necessitate careful consideration. Investors will need to stay informed about the DRC’s ongoing policies and how they might reshape the global cobalt landscape.

The Broader Implications for Technology and Innovation

As the world moves toward more sustainable energy solutions, cobalt’s role is pivotal. Innovations within the battery technology space may lessen reliance on cobalt over time, leading to a potential transformation in its market dynamics. However, for now, cobalt remains essential for existing technologies, particularly lithium-ion batteries found in everything from smartphones to electric vehicles.

Final Thoughts

That said, the dip in prices following the DRC’s announcement illustrates the fragility of market dynamics in the commodities sector. Stakeholders from miners to manufacturers must navigate these waters with agility, adapting to the new landscape that regulatory changes will inevitably create. As the situation evolves, keeping a close watch on regulatory developments and market responses will be crucial for anyone involved in the cobalt supply chain.