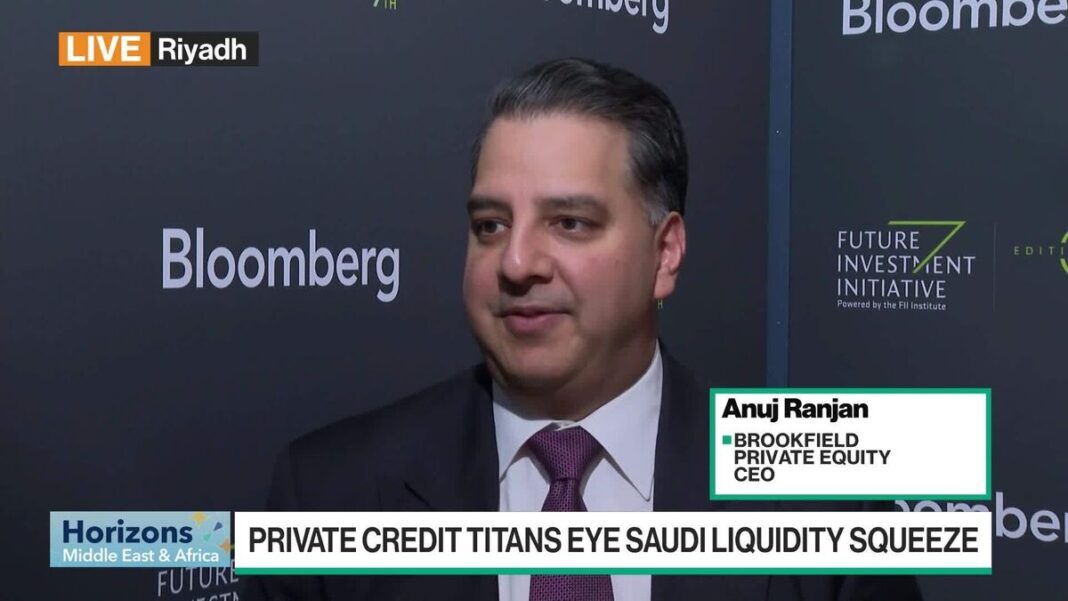

Anuj Ranjan on the Future of Private Equity

At the Future Investment Initiative in Saudi Arabia, Anuj Ranjan, Brookfield Asset Management Ltd.’s Head of Private Equity, shared some exciting insights into the evolution of the private equity sector. As industries continue adapting to economic shifts and increasing investor demand, Ranjan believes that private equity is on the verge of significant growth, closely mirroring the burgeoning landscape of private credit.

The Surge in Deal Activity

One of Ranjan’s key points was the dramatic increase in deal activity within the private equity space. The dynamics of the market have shifted, evidenced by an uptick in transactions, as investors become more confident in deploying capital. Ranjan notes that this resurgence reflects a broader trend of businesses seeking funding to expand and innovate. Companies are realizing the value that private equity can bring, particularly in strategic guidance and operational enhancement.

Intersection of Private Equity and Private Credit

Ranjan highlights a fascinating intersection between private equity and private credit. As enterprises look to diversify their funding sources, private credit has emerged as a critical component in supporting growth initiatives. The synergy between these two sectors is evident, as private equity firms increasingly leverage private credit to finance acquisitions or bolster their portfolio companies. This collaboration creates a robust financial solution that enhances flexibility for businesses navigating a competitive landscape.

Global Landscape and Regional Insights

The Future Investment Initiative served as an ideal backdrop for these discussions, emphasizing the global nature of investment and the importance of regional insights. Ranjan pointed out that the Middle East is becoming a focal point for private equity, with its vast wealth and increasing interest in alternative investments. Investors are actively seeking opportunities in emerging markets, particularly where innovation and growth potential are ripe. The region’s focus on diversifying its economy away from oil dependency adds even more fuel to this fire.

Challenges and Opportunities Ahead

While optimism abounds, Ranjan also acknowledged the challenges that lie ahead. Economic uncertainty, fluctuating interest rates, and geopolitical factors can influence investor sentiment and deal-making activity. However, these challenges also pave the way for opportunities. Private equity firms that can navigate these complexities and identify resilient businesses stand to thrive in this changing landscape. Ranjan emphasizes the importance of agility and foresight in making investment decisions that align with long-term value creation.

The Role of Technology in Private Equity

Another intriguing aspect of private equity’s evolution is its increasing interplay with technology. Ranjan remarked on how advancements in data analytics and artificial intelligence are reshaping investment strategies. Firms are harnessing technology not only to streamline operations but also to identify potential investment opportunities. The ability to analyze vast amounts of data enables private equity professionals to make informed decisions and assess risks more effectively.

Future Outlook

In the context of these developments, Ranjan is hopeful about the private equity landscape’s future. With a confluence of market forces driving innovation and growth, the sector is poised for considerable expansion. As institutions and individual investors look for attractive returns, private equity will likely remain a compelling option, particularly for those looking to capitalize on transformative business opportunities.

Engaging with New Investors

Ranjan also noted the importance of engaging with a new generation of investors. As millennials and Gen Z begin to accumulate wealth, their investment preferences differ markedly from previous generations. Thus, private equity firms must adapt their strategies to align with the values and interests of these emerging investors, who often prioritize sustainability and social impact alongside financial returns.

In the ever-evolving landscape of finance, Anuj Ranjan’s insights at the Future Investment Initiative reveal a private equity sector not only on the rise but also adapting in dynamic ways to meet the challenges of a modern economy. The intersection of private equity, credit markets, technology, and younger investors highlights a landscape rich with potential for innovative growth.