Investment Banking’s Resurgence: A 2025 Landscape

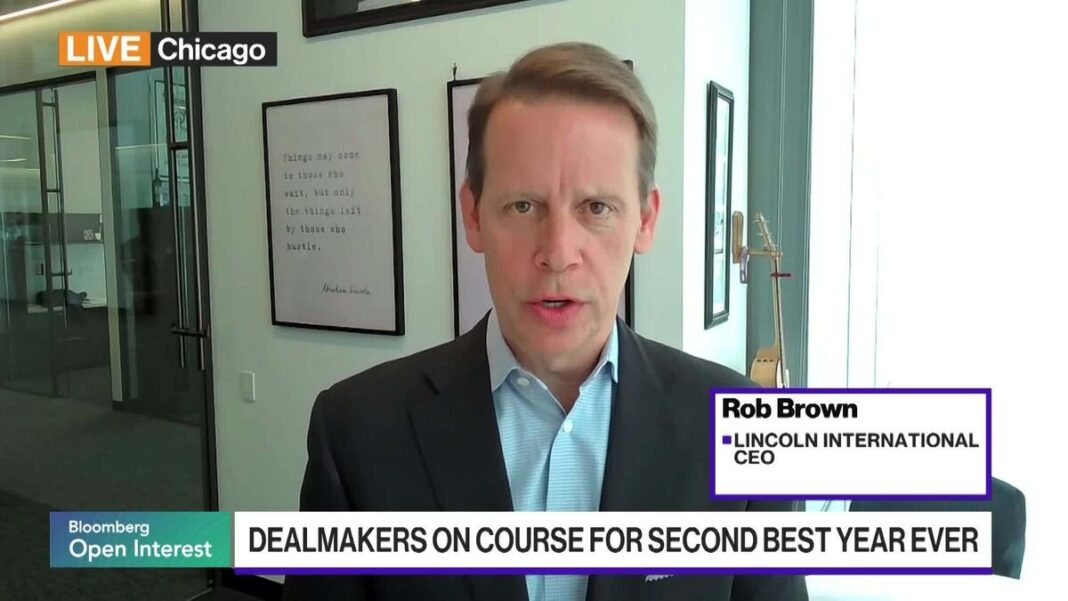

Investment banking has experienced a rollercoaster journey in the last few years. After a challenging start to 2025, new data shows a remarkable turnaround with dealmaking soaring to nearly $4 trillion. This sharp increase signals a potential revival in the industry, positioning it for what could be its best year since 2021. The excitement surrounding mergers and acquisitions (M&A) has caught the attention of industry leaders, including Rob Brown, the CEO of Lincoln International, who recently shared insights on the dynamics driving this resurgence.

The Current State of Dealmaking

The year 2025 has seen a significant uptick in global dealmaking activity. Multiple factors are fueling this momentum, including favorable economic conditions, stabilized interest rates, and an influx of private equity capital eager to deploy funds. Robust corporate earnings and a gradual return to pre-pandemic levels of economic activity are also playing key roles. With nearly $4 trillion in M&A activity projected, investment banks are adapting to this rapidly changing landscape, capitalizing on renewed corporate confidence to facilitate transactions that were previously stalled.

Factors Driving the M&A Boom

-

Economic Stabilization: After years of uncertainty, both macroeconomic stability and low inflation rates have restored confidence among businesses. Companies are now willing to engage in M&A to grow, innovate, or consolidate, believing that acquisitions can provide strategic advantages in competitive markets.

-

Private Equity Interest: The abundance of capital in private equity has significantly influenced the M&A landscape. With funds raised during the pandemic now coming to life, private equity firms are actively seeking acquisition targets, further stimulating competition and driving valuations higher.

-

Technological Advancements: The rapid pace of technological change has compelled companies from various sectors to reassess their strategic goals. Dealmaking in tech and life sciences is particularly vigorous, as firms seek partnerships or acquisitions to bolster their technological capabilities, streamline operations, and enhance their market positions.

Insights from Rob Brown

Rob Brown of Lincoln International is optimistic about the current state of the industry. During his discussion on “Bloomberg Open Interest,” he highlighted several trends that signal a positive shift in the M&A landscape. According to Brown, the renewed interest in acquisitions stems from companies striving to adapt to new consumer behaviors and expectations shaped by the COVID-19 pandemic.

He noted that businesses are increasingly recognizing the value of mergers and acquisitions as a path to growth. This acknowledgment is not merely reactive; firms are actively seeking opportunities to acquire companies that can complement their strengths or fill gaps in their product offerings.

The Role of Investment Banks

In this rebuilt landscape, investment banks play an essential role in guiding both buyers and sellers through complex transactions. They provide crucial support in valuation, due diligence, and negotiation—ensuring that deals proceed smoothly and meet the strategic goals of their clients. Investment banks are not only facilitators but also trusted advisors who can identify opportunities that align with long-term corporate strategies.

As the M&A wave continues to build, we may see banks adapting their structures and strategies to accommodate the growing demands placed upon them. Embracing technology to improve efficiency and enhance client service will be critical in this new environment.

Looking Ahead

The momentum in M&A is set to continue as the desire for strategic growth remains strong among corporations. With investment bankers capitalizing on favorable economic indicators, a steady pipeline of potential deals is likely. Companies are enthusiastic about leveraging M&A to optimize portfolios, diversify their offerings, or enter new markets.

As they navigate this dynamic landscape, industry players will need to remain vigilant and adaptive. The ability to foresee trends, manage risks, and tailor approaches will define successful investment banks in the post-pandemic world.

Investment banking may have faced challenges at the beginning of 2025, but the current landscape is vibrant and full of opportunity. Dealmaking is on the rise, and industry leaders are embracing this moment of renewal with optimism and strategic intent. The journey may continue to evolve, but the thrill of M&A is back, and it’s shaping up to be a remarkable chapter in investment banking history.