Investors Await Japan’s 20-Year Government Bond Auction

As Japan prepares for its auction of 20-year government bonds this Wednesday, investors are feeling a mix of anticipation and anxiety. The current climate reflects broader economic uncertainties, particularly as many buyers adopt a cautious approach ahead of the government’s upcoming announcement of an economic stimulus package. Let’s delve into the key factors influencing this auction and the market responses.

Economic Context

The Japanese economy has been navigating through a complex landscape characterized by sluggish growth and persistent inflation. With the Bank of Japan’s (BoJ) commitment to maintaining low interest rates, investors are closely monitoring any signals that could affect monetary policy. As the government gears up to reveal its economic stimulus plan, the potential for changes in fiscal strategy is adding to the suspense surrounding the bond auction.

Investor Sentiment

Investor sentiment plays a crucial role in bond demand, and right now, many are on edge. With the stimulus package looming, some buyers are hesitant to commit, wary of how the new policies might reshape market dynamics. This caution could lead to weaker demand for the 20-year bonds, raising concerns about whether the auction will meet its targets.

Historical Trends in Bond Auctions

Historically, Japan’s bond auctions have drawn considerable interest, often due to the country’s status as one of the largest debt issuers globally. However, recent trends show a pattern of fluctuating demand, influenced by global economic conditions and shifting investor risk appetites. The upcoming auction could shed light on whether these recent trends will continue or if a renewed interest in government bonds will emerge.

Implications of Weak Demand

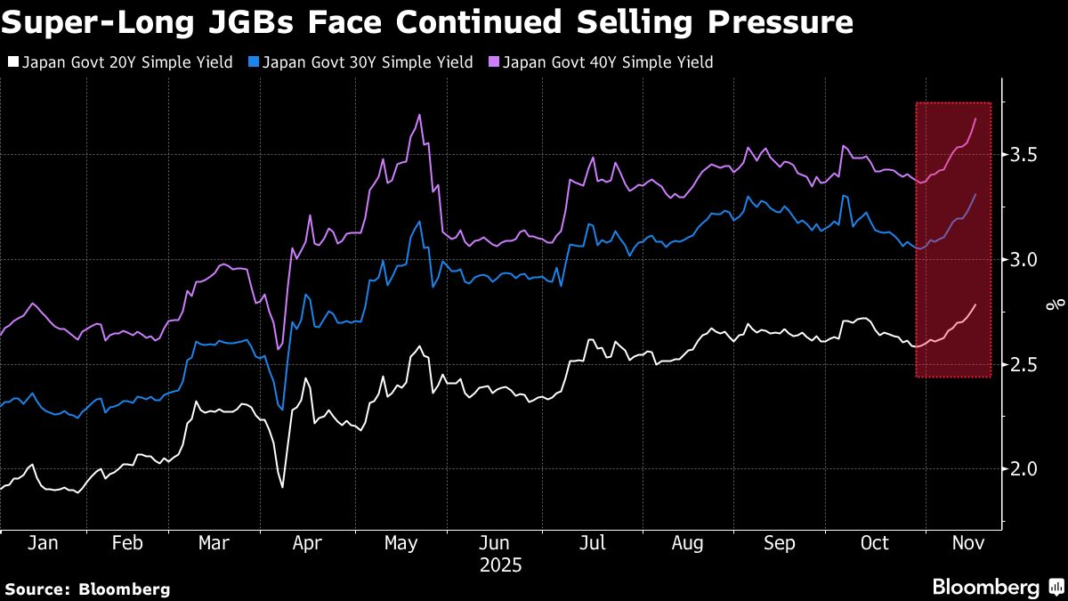

Should the demand for the 20-year government bonds fall short, there could be several ramifications for both the Japanese economy and global markets. A weak auction might signal diminished confidence in Japan’s fiscal strategies, potentially prompting a rise in yields, which could further complicate the country’s economic recovery. The implications would reach beyond Japan, affecting bond markets worldwide as investors reassess risk and returns.

Fiscal Policy Expectations

With the stimulus package on the horizon, investors are not just focused on the auction itself but also on the broader economic implications of the government’s fiscal policies. Analysts speculate that a robust package could boost economic activity, although the effectiveness of such measures remains to be seen. Investors are keenly aware that successful implementation of these policies would be critical to stimulating growth and ensuring the stability of government bonds.

Potential Market Reactions

Regardless of the outcomes of the auction, the reactions in financial markets are likely to be swift and telling. Should the government unveil a comprehensive stimulus plan alongside a successful bond auction, we might see a rally in the Japanese equity markets. Conversely, a weak auction could lead to increased volatility as investors recalibrate their expectations for future monetary and fiscal policies.

Conclusion

As Wednesday approaches, all eyes are on Japan’s 20-year government bond auction. Investors remain cautiously optimistic, with their decisions heavily influenced by the anticipated economic stimulus package. The interplay between investor sentiment, historical auction trends, and fiscal policy expectations will undoubtedly shape the outcome and market responses in the days to come.