Welcome Back from My European Travels!

Hi, folks! After an invigorating trip across Europe, I’m back and ready to dive back into blogging. I’ve got a lineup of posts in the pipeline, but your input is invaluable. If there’s a particular topic you’d love for me to explore, just drop it in the comments!

Podcast Episode: Econ 102 with Erik

First up, here’s an episode of Econ 102, where Erik and I discuss a variety of topics that are at the forefront of economic thought today.

The American Economy and AI Investment

One pressing question that has emerged in current economic discussions is the future of the American economy and its political landscape hinging on the trajectory of AI investments. In a previous post, I mentioned that the potential crash could stem from overestimating AI’s capacity to generate real returns quickly, rather than the classic signs of a financial bubble.

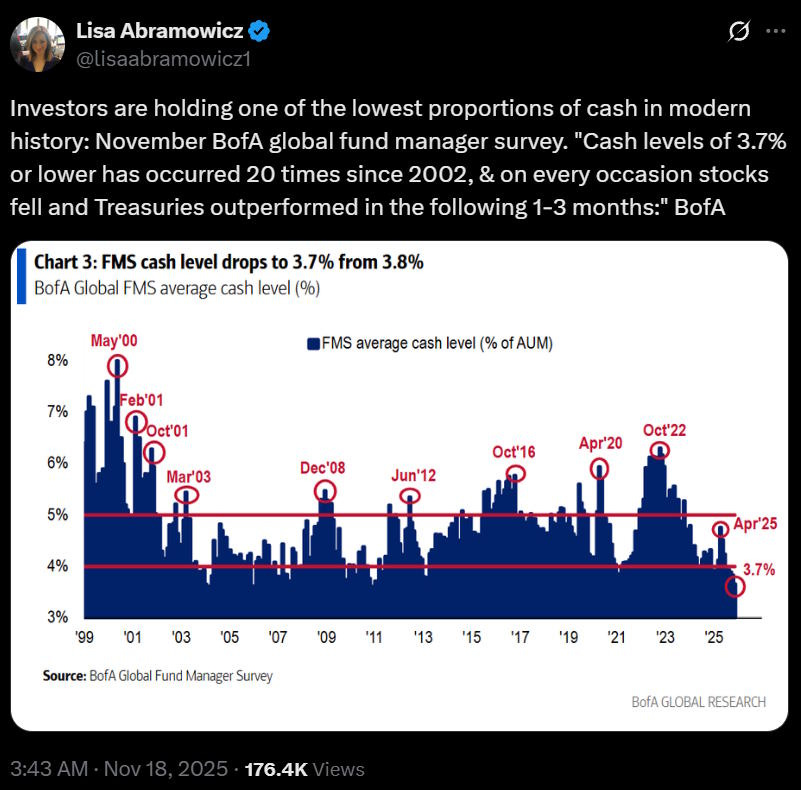

But I might be mistaken. There might be traditional bubble dynamics at play, such as herd behavior and psychological factors like Fear of Missing Out (FOMO), driving actual investments in AI. A critical indicator to watch would be the drying up of investor liquidity.

In many models predicting financial bubbles, like the extrapolative expectations model, people stop investing when they’ve simply run out of cash. Recent stories indicating AI investors are starting to, quite literally, run out of cash signal a red flag.

In recent times, tech giants like Google and Meta often funded their AI ventures from their profits, but reports suggest that data center builders are now having to resort to borrowing. That’s concerning, as such a trend can’t sustain itself indefinitely.

Economic Models and Tariffs

Previously, economists correctly asserted that tariffs under Trump would negatively impact U.S. manufacturing by complicating the purchase of intermediate goods. Yet, the ongoing debate surrounds whether those tariffs have triggered inflation. Some, like JD Vance, are starting to argue otherwise.

Taking a step back, it’s worth mentioning that it’s crucial to avoid sweeping claims about the economics profession based on missed forecasts. The field isn’t inherently designed for macroeconomic forecasting, which is, quite frankly, an uncertain science.

By examining various pathways through which tariffs impact prices—raising them directly while also making production costlier—we touch on the delicate balance tariffs strike between inflationary and disinflationary effects. If an economic disruption leads to a reduction in aggregate demand, inflation could very well subside.

Solarpunk: The Future of Africa

Amidst all this, I find the solarpunk movement particularly intriguing. While some envision a cyberpunk future shaped by immense corporate power, others propose a solarpunk vision rooted in community-led movements.

The astonishing strides in solar technology across Africa are illuminating the continent and presenting an alternative infrastructure model. Innovative startups are bypassing traditional government frameworks to bring solar power directly to farmers, yielding impressive results.

“What’s happening across Sub-Saharan Africa right now is the most ambitious infrastructure project in human history.”

The emergence of decentralized solar energy has profound implications for energy accessibility, particularly in areas where traditional infrastructure falters.

The Declining Extinction Rates

Bolstering optimism amid environmental challenges, research indicates that extinction rates might be decreasing due to concerted conservation efforts. Factors such as the environmental Kuznets curve may be at play, where increased wealth correlates with greater concern for animals and ecosystems.

The notion that a wealthier society prioritizes conservation suggests that we are gradually tackling habitat destruction, with more people becoming actively engaged in preservation efforts.

Rethinking Financial Strategies

Reflecting on historical decisions, we consider George W. Bush’s controversial attempts to invest Social Security funds in higher-yielding assets. Recent analyses, particularly around Japan’s public finance strategy, suggest there could be merit in revisiting such models to leverage stock market growth for public funds.

Japan’s innovative approach to managing high levels of sovereign debt raises compelling questions: Could a similar investment strategy bolster U.S. financial stability?

Immigration Policy Quagmire

An ongoing examination of U.S. immigration policy reveals a startling lack of coherent direction. Events like the unjust ICE raid on a South Korean battery factory illustrate the chaotic dynamics influencing immigration enforcement, often driven by quotas rather than thoughtful decision-making.

The implications of a decentralized policy-making system raise significant concerns about national interests and the coherence of U.S. immigration strategies.

Electric Tech and Global Power Dynamics

Finally, the discourse around electric technology and its strategic significance within global power dynamics has been gaining traction. It’s becoming increasingly apparent that the U.S. must reframe the narrative surrounding electric vehicles; these are not merely environmental solutions but pivotal components of future industrial strength.

With the U.S. lagging behind China in the electric vehicle sector, the stakes have never been higher. Recognizing the broader implications of technological leadership in this sphere is crucial for preserving national power and influence on the global stage.

I look forward to your thoughts and discussions on these topics! Don’t hesitate to suggest what you’d like to see next – I’m here for it!