Betting Against US Stocks: A Deeper Dive into Economic Indicators and AI Enthusiasm

As investors and analysts alike keep a close eye on the stock market, the specter of potential downturns looms large, especially for those considering betting against US stocks this month. Understanding the intricacies of the American economy, alongside the burgeoning enthusiasm surrounding artificial intelligence (AI), offers valuable insights for navigating the market landscape.

The Resilience of the American Economy

At the heart of any investment decision is the underlying strength of the economy. The US economy has demonstrated remarkable resilience amid challenges like inflation and geopolitical tensions. Key economic indicators—such as low unemployment rates, consistent consumer spending, and robust GDP growth—paint a picture of stability. These factors contribute to an environment where stock prices can remain buoyant, posing risks for those looking to short the market.

Low unemployment rates suggest not only job security but also consumer confidence. When people feel secure in their jobs, they are more likely to spend, which helps drive economic growth. This, in turn, supports businesses and can safeguard against sharp drops in stock prices.

Inflation Trends and Interest Rates

However, inflation remains a consideration that could influence market dynamics. While recent trends show signs that inflation may be moderating, the Federal Reserve’s responses—primarily through interest rate hikes—remain significant. Higher interest rates can cool down economic activity, affecting not just consumer spending but also borrowing costs for businesses.

Investors should monitor these developments closely. A scenario where the Fed continues to raise rates could create headwinds for stocks, particularly those in interest-sensitive sectors like real estate and technology. Conversely, a pause in rate hikes could further fuel optimism in the markets.

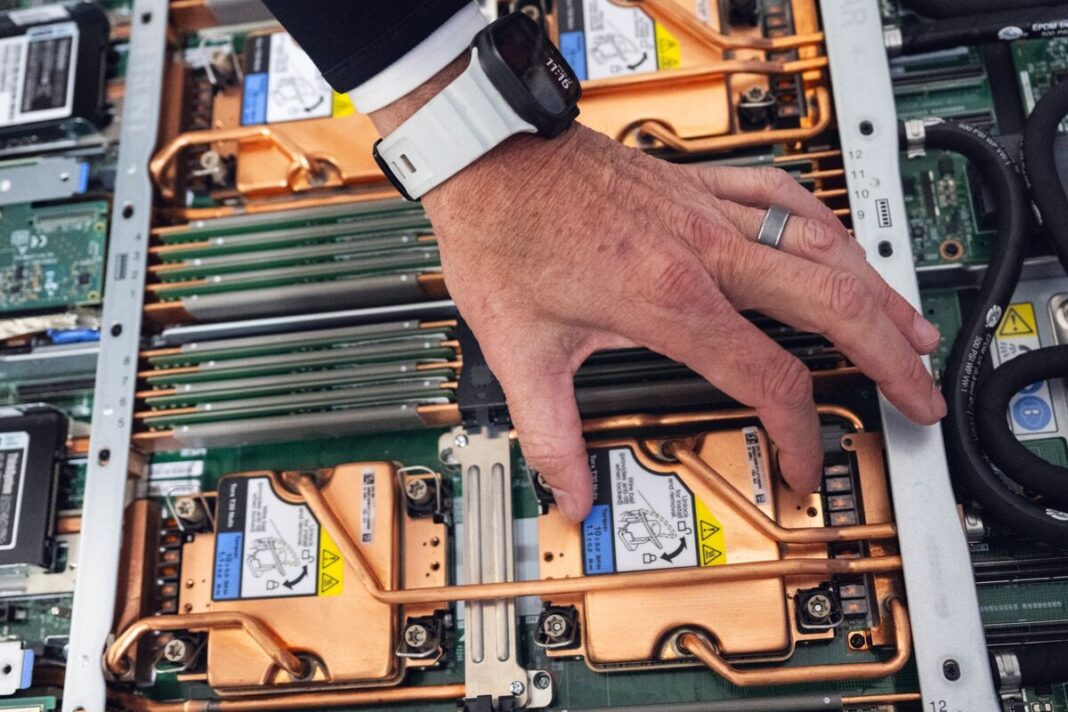

The AI Surge: Transforming Industries

In a world increasingly dominated by technology, one area of undeniable growth is artificial intelligence. The excitement around AI has transcended the tech sector, impacting various industries—healthcare, finance, manufacturing, and more. Companies are racing to integrate AI capabilities to enhance efficiency and innovation, leading to significant investments and stock valuations.

This enthusiasm for AI is a double-edged sword. For those betting against stocks, it introduces a complication: the potential for explosive growth in tech stocks. The narrative around AI can elevate stock prices even in the face of broader economic challenges. Therefore, understanding which companies are poised to benefit from AI advancements—and which may struggle—is crucial when considering short positions.

Market Sentiment and Investor Psychology

Beyond economic indicators and technological advancements, investor sentiment plays a crucial role in stock market movements. The current market climate is characterized by a blend of optimism around technological innovation and caution stemming from economic uncertainties. Investors must gauge how these sentiments could influence market trends.

Bullish sentiments can sustain stock prices, even if fundamentals suggest otherwise. Conversely, panic or anxiety can trigger sharp sell-offs. As such, it’s essential to read between the lines during earnings reports and economic announcements. Market reactions often reflect not only the facts but also the mood of investors.

Sector-Specific Considerations

When contemplating a bet against stocks, sector dynamics are paramount. Some sectors are more vulnerable during economic downturns—consumer discretionary, for example, tends to suffer as households cut back on non-essential spending. In contrast, defensive sectors such as healthcare and utilities often provide resilience.

Investors should consider which sectors may be overvalued due to inflated growth expectations, particularly in light of the AI hype. Identifying stocks with lofty valuations that may not be able to sustain high expectations can provide opportunities for those looking to short the market.

Conclusion: Navigating the Landscape

The decision to bet against US stocks in a landscape marked by economic resilience and AI enthusiasm requires careful analysis. It’s essential to weigh the underlying economic indicators, keep an eye on inflation trends and interest rates, and monitor market sentiment. With distinct sectors reacting differently to these factors, a strategic approach is crucial for making informed investment decisions in this complex environment.