Fermi America: Navigating Challenges in the Texas Panhandle

In September, Fermi America announced a bold initiative to develop an 11-gigawatt data center campus in the Texas Panhandle. This ambitious project aims to address the surging energy demands driven by data centers, particularly with the rising influence of artificial intelligence. Initially, Fermi revealed that it had secured a nonbinding letter of intent with an investment-grade tenant to anchor its project, which would utilize the first gigawatt of power across 12 facilities.

Stock Market Woes and Contractual Setbacks

However, setbacks soon followed. On December 12, Fermi’s stock experienced a significant downturn, plummeting nearly 50% after the company disclosed that a prospective partner had canceled a $150 million advance needed to commence construction. This arrangement, known as an Advance in Aid of Construction Agreement (AICA), was crucial for kickstarting operations. The cancellation coincided with the conclusion of an exclusivity period, raising concerns about the project’s viability.

Amazon Steps In

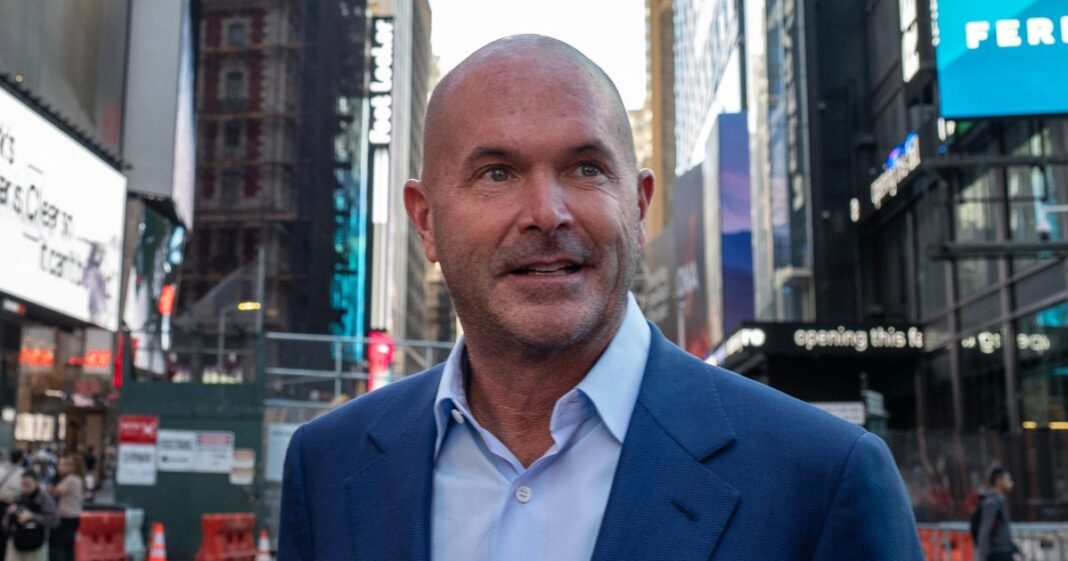

Amidst the turmoil, it was confirmed that Amazon would be the tenant anchoring Fermi’s project, as stated by Fermi’s CEO, Toby Neugebauer, in a December 15 conversation with Business Insider. This substantial deal, expected to total over $20 billion over the next 20 years, represents a significant commitment from the tech giant. Neugebauer emphasized the importance of this partnership during discussions about the recent cancellation.

Ongoing Negotiations

Despite the recent challenges, Neugebauer expressed optimism that negotiations with Amazon were still productive. He clarified that the cancellation of the AICA did not signify a breakdown in discussions but rather reflected standard negotiating practices. “Big deals take longer,” Neugebauer noted, reassuring stakeholders that the company was navigating these complexities adeptly.

Details of the Project

Fermi’s Panhandle project, known as Project Matador, is touted as one of the largest attempts to meet the growing energy demands of data centers that are fueling the AI revolution. The company plans to bring 11 gigawatts of power online over the next decade, balancing sources from the grid, natural gas, and nuclear facilities. This comprehensive energy strategy highlights the company’s ambition to contribute sustainably to a rapidly evolving sector.

Public Offering and Financial Context

Fermi made headlines by going public in September, pricing shares at $21 and raising over $680 million in the process. However, the recent dip in stock prices has seen the company’s valuation drop below $6 billion, a stark contrast to its nearly $14 billion valuation after the IPO.

Lease and Tenant Relations

Central to the project’s success is a 99-year ground lease with the Texas Tech University System, contingent upon securing a signed letter of intent with a tenant. The December 12 filing indicated that no funds from the $150 million construction advance had been used, affirming the ongoing discussions with Amazon, which are vital for the project.

Insights from Analysts

Analysts from Cantor Fitzgerald provided insight into the situation, revealing that there were attempts by the anchor tenant to make last-minute changes to the agreement’s pricing that Fermi found unacceptable. The headwinds facing the company underscore the complexities of aligning the interests of multiple stakeholders in such a high-stakes project.

Other Prospective Tenants

Interestingly, Amazon is not the only company eyeing Fermi’s ambitious project. Neugebauer previously mentioned that Palantir Technologies, renowned for its AI software and government contracts, had shown interest in developing the site. Such collaborations could diversify Fermi’s portfolio and stabilize its financial outlook amid ongoing negotiations with major players.

Future Prospects

Looking ahead, Fermi America continues to engage with various prospective tenants, expressing hope for fruitful partnerships that could enhance its operational capacity. The company remains optimistic about its long-term prospects, despite the fluctuations in its stock and the pressures of negotiating with established giants like Amazon.

Through strategic planning and collaborative efforts, Fermi aims to establish itself as a key player in the rapidly expanding data center market, navigating challenges while striving for growth in the Texas Panhandle.