Understanding the Recent Yuan Reference Rate Adjustment in China

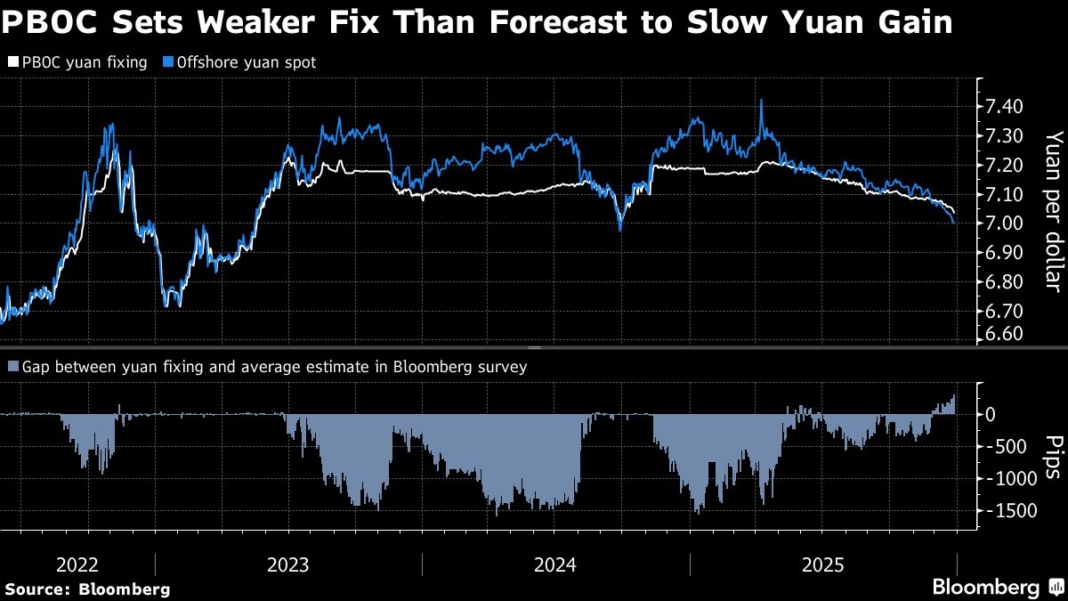

In a significant move that has caught the attention of global financial markets, China recently set the yuan’s daily reference rate at a level substantially below market estimates. This decision marks the most considerable deviation in history, highlighting the government’s intent to manage the currency’s appreciation. Let’s delve into the implications and reasons behind this noteworthy policy action.

What is the Yuan’s Daily Reference Rate?

The yuan, officially known as the renminbi (RMB), is China’s primary currency. The People’s Bank of China (PBOC), the country’s central bank, establishes a daily reference rate for the yuan against the U.S. dollar based on a basket of currencies. This rate serves as a benchmark for financial institutions, guiding how they set their own exchange rates. Traders can trade the yuan within a certain band around this reference rate, allowing for some market-driven fluctuations while maintaining government oversight.

Historical Context: Recent Trends in the Yuan’s Value

In the past year, the yuan experienced significant strengthens against the U.S. dollar, driven by various factors such as China’s improving economic outlook, robust export performance, and the appeal of riskier assets. This appreciation can be perceived as a double-edged sword; while it benefits consumers by making imports cheaper, it can negatively impact exporters by making their goods less competitive abroad.

The government’s approach to manage currency valuation reflects its ongoing attempts to balance between economic growth and stability, particularly in a changing global economic climate.

Implications of Setting the Reference Rate Below Market Estimates

Setting the reference rate below market estimates sends a strong signal to traders and investors. This strategic maneuver aims to undermine speculation on the yuan’s appreciation, reinforcing the government’s commitment to maintaining a competitive export landscape. By controlling the currency’s value more aggressively, Beijing hopes to stabilize economic conditions, particularly as recovery from the pandemic continues to unfold.

Market Reactions: Analyzing Trader Sentiments

Following the announcement, market responses varied. Traders interpreted the action as a signal that the PBOC is wary of excessive yuan strength, which could hinder China’s export growth. Consequently, this led to a wave of selling in the currency, as investors recalibrated their expectations. The deviation from market estimates also raises questions about the central bank’s future interventions, stirring discussions among economic analysts about the long-term implications for China’s currency policy.

The Broader Economic Context

The yuan’s valuation is intertwined with broader economic indicators. With China striving to re-establish strong growth post-pandemic, influencing the currency is just one of the tools policymakers are using. Factors such as international tariffs, commodity prices, and economic recovery rates from key partners influence this environment. As countries around the world navigate inflation, labor market fluctuations, and geopolitical tensions, observing how China manages the yuan offers valuable insights into its economic strategy.

Future Outlook: Will the Yuan Continue to Strengthen or Weaken?

Current policies and market reactions suggest that the PBOC is keen on maintaining a flexible yet controlled approach with the yuan’s exchange rate. Analysts are closely monitoring future moves, anticipating potential adjustments based on domestic economic performance and external pressures from global markets. Understanding these shifts will be critical for businesses engaged in trade with China and investors looking to navigate the intricate landscape of the forex market.

Conclusion

China’s recent policy to set the yuan’s reference rate below market expectations illustrates the ongoing balancing act of its economic strategy. As the world watches closely, the implications of these actions will reverberate through global markets, showcasing the intricate relationship between currency valuation and economic policy. For traders, businesses, and policymakers alike, these developments underscore the importance of understanding not just the yuan, but also the myriad factors that influence its value.