Thermoelectric Seat Heating and Cooling Market Forecast and Outlook 2026 to 2036

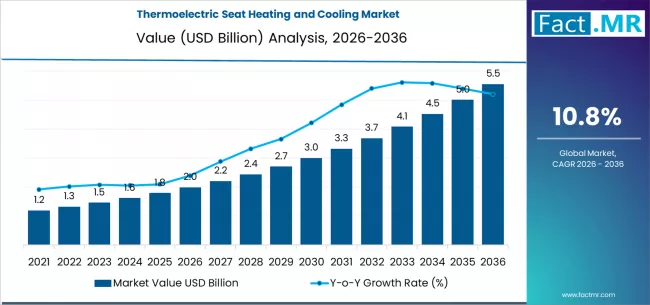

The global thermoelectric seat heating and cooling market is on an impressive growth trajectory, expected to escalate from USD 1.99 billion in 2026 to USD 5.07 billion by 2036. This remarkable increase represents a compound annual growth rate (CAGR) of 10.8%. In simpler terms, the market is projected to grow by 154.8%, showcasing an increasing demand for advanced temperature management solutions in automotive applications. Notably, the thermoelectric segment is anticipated to dominate, accounting for 52.8% of the market share by 2026.

Key Takeaways from the Thermoelectric Seat Heating and Cooling Market

- Market Value (2026): USD 1.99 billion

- Forecast Value (2036): USD 5.07 billion

- Projected CAGR (2026 – 2036): 10.8%

- Leading Device Category: Thermoelectric (52.8% of the market)

- Growth Regions: North America, Europe, Asia Pacific

- Key Players: Gentherm, Lear, Adient, Faurecia, Hyundai Mobis

The Role of Thermoelectric Systems

Thermoelectric control systems are revolutionizing how vehicle manufacturers approach cabin comfort. These systems provide enhanced temperature management, ensuring optimal operational efficiency across various vehicle conditions. Key to their appeal is the quality of comfort they deliver for passengers while maintaining overall cost-effectiveness.

Passenger vehicles are projected to hold a significant position in the market, with an estimated 55.0% share in 2026. The integration of sophisticated temperature control mechanisms enhances the efficiency and efficacy of automotive comfort, ensuring compliance with regulatory standards and improving the overall occupant experience.

Thermoelectric Seat Heating and Cooling Market Overview

| Metric | Value |

|---|---|

| Estimated Value in (2026E) | USD 1.99 billion |

| Forecast Value in (2036F) | USD 5.07 billion |

| Forecast CAGR (2026 to 2036) | 10.8% |

Segment Analysis: Market Dynamics

Dominance in Technology

The thermoelectric segment is set to lead the market with a commanding 52.8% share. The precision control capabilities and operational efficiencies of thermoelectric systems are increasingly favored by automotive comfort specialists.

- Manufacturers are pouring investments into advanced comfort technologies, ensuring that thermoelectric modules align well with the vehicle performance standards and comply with operational protocols.

- The importance of vehicle comfort cannot be overstated, making thermoelectric systems a fundamental aspect of modern automotive design.

Vehicle Categories

Passenger vehicles notably dominate the market, representing a significant 55.0% share. This comes as no surprise given that manufacturers prioritize seating comfort and regulatory adherence for passengers.

- Automotive facilities are adopting thermoelectric solutions to elevate operational capabilities.

- The continuous advancement in comfort technology suggests that passenger vehicle applications will steer future market growth.

Market Drivers and Restraints

Key Drivers

- The automotive industry’s push for enhanced comfort performance and advanced temperature management is a key driver behind the growth of thermoelectric solutions.

Restraints

- Conversely, high component costs and the technical complexities associated with implementing sophisticated comfort protocols present significant barriers to market penetration.

Emerging Trends

- Automated comfort configurations are gaining traction, minimizing operational requirements and reducing costs for vehicle management.

- There’s a growing trend towards developing multi-parameter compatibility systems, which cater to various vehicle applications and operational conditions.

Regional Insights: Country-Specific Performance

| Country | CAGR (2026 to 2036) |

|---|---|

| China | 13.1% |

| Brazil | 12.9% |

| U.S. | 10.1% |

| South Korea | 9.7% |

| Germany | 9.9% |

| U.K. | 9.8% |

| Japan | 9.0% |

Opportunities in Key Regions

China stands out with a projected CAGR of 13.1%, underscored by rapid advancements in automotive infrastructure and regulations aimed at enhancing vehicle efficiency.

Brazil is not far behind, with a growth forecast of 12.9%, spurred by rising investments in automotive technology and expanding service capabilities.

In the U.S., anticipated market growth is pegged at 10.1%, fueled by a focus on operational precision and state-of-the-art technology integration.

Germany and the U.K. also demonstrate potential, with CAGRs of 9.9% and 9.8% respectively, driven by a commitment to quality control and precision performance in the automotive sector.

Competitive Landscape

The competitive space within the thermoelectric seat heating and cooling market is bustling, populated by key players like Gentherm, Lear, and Adient. These corporations are enthusiastically investing in advanced technologies and innovative solutions to maintain a competitive edge.

Leading competitors aim to deliver high-quality, reliable thermoelectric control module services that enhance vehicle comfort, pushing the industry toward quicker adoption of innovative solutions.

Key Players in the Market

- Gentherm

- Lear

- Adient

- Faurecia

- Hyundai Mobis

- Magna

- Denso

- Valeo

- Hanon Systems

- Bosch

Report Scope and Segmentation

| Items | Values |

|---|---|

| Quantitative Units (2026) | USD 1.99 Billion |

| Vehicle Categories | Passenger Vehicles, LCV, Premium, Other |

| Technology Types | Thermoelectric, Ventilated, Liquid-Cooled |

| Functionality | Heated + Cooled Seats, Other |

| Sales Channels | OEM, Dealer Options, Aftermarket, Other |

| Geographic Scope | North America, Europe, Asia Pacific, Latin America, MEA |

Bibliography

- International Automotive Technology Association Research Committee. (2023). Comfort technologies and performance optimization in automotive control systems.

- ISO. (2023). Vehicle quality management: Assessment of comfort technology, operational efficiency, and quality control of thermoelectric systems.

- CEN. (2022). Vehicle quality management: Evaluation of comfort processing and compliance in automotive facilities.

- Journal of Automotive Comfort, 150(4), 245-262.

- Automotive Technology Agency, Technical Committee. (2023). Advances in comfort processing for automotive applications.