The Rise of Exchange-Traded Products: A Hedge Against Market Volatility

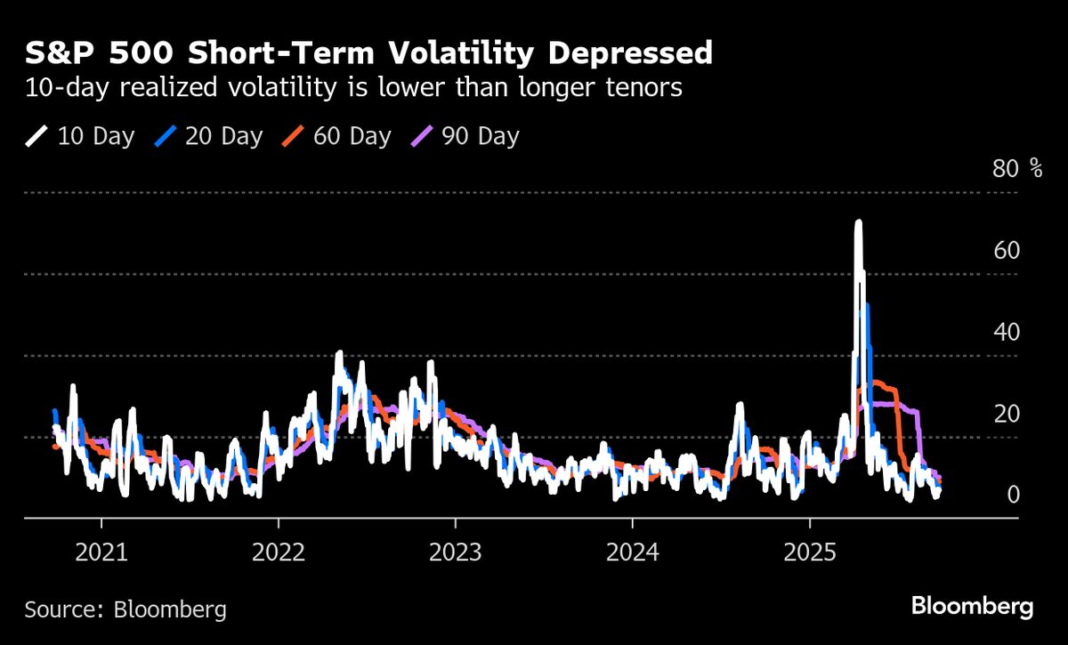

In recent times, investors have shown a renewed interest in exchange-traded products (ETPs), particularly those designed to capitalize on stock-market volatility. With stock-market volatility hovering at historically low levels, many believe that a spike is on the horizon, prompting them to position themselves strategically. But while they’re hopeful for a flourish in returns, there’s a hidden quirk in the market that’s dampening their immediate gains. Let’s delve into this intriguing situation and explore the intricacies involved.

Understanding Exchange-Traded Products

Exchange-traded products, including exchange-traded funds (ETFs) and exchange-traded notes (ETNs), are popular investment vehicles that trade on stock exchanges just like individual stocks. These products aim to track the performance of an underlying index or commodity, making them a convenient option for investors looking to diversify their portfolios without directly holding the underlying assets. Given their versatility and accessibility, ETPs have quickly caught the attention of those aiming for gains from market movements, especially in periods of volatility.

The Allure of Volatility

Volatility is often viewed as a double-edged sword in the investment world. On one hand, experienced traders relish it as an opportunity for profit. On the other, it can also present significant risks that can quickly erode gains. As the market stabilizes and volatility subsides, many investors become anxious, wondering when the next big shift will create lucrative trading opportunities. This anticipation has fueled the growing interest in ETPs aligned with volatility measures, such as the Cboe Volatility Index (VIX).

The Hunt for Higher Returns

Investors are drawn to volatility-related ETPs with the belief that a market rebound is imminent. But while their focus is on potential spikes in volatility, they often overlook the immediate impact of historically low levels of market turbulence. Many of these products are designed to perform in a rising volatility environment—but in the interim, they may not deliver the returns that investors expect. In fact, when volatility is low, the returns of these ETPs can dwindle significantly, leading to frustrating outcomes for those who are eager for quick gains.

The Curiosity of Contango and Backwardation

A significant factor contributing to the underwhelming performance of these ETPs is the market phenomena known as contango and backwardation. In contango, the futures prices of an asset are higher than the expected future spot price, often seen in volatility products when the market is calm. When traders roll over contracts, they may be buying into higher-priced futures, which can erode returns. Conversely, backwardation involves future prices that are lower than the current spot price, generally offering better potential for returns. The interplay between these factors can create complexities that investors must navigate carefully.

Reassessing Risk Tolerance

With these dynamics at play, investors should take a moment to reevaluate their risk tolerance and investment strategies. The promise of profits tied to volatility isn’t simply about choosing the right ETP; it’s also about understanding the underlying mechanics of how these products react in different market conditions. A careful assessment of one’s risk appetite can help mitigate potential losses and align expectations more realistically.

The Role of Market Sentiment

Market sentiment also plays a crucial role in the performance of ETPs tied to volatility. As more investors jump on the bandwagon, the collective anticipation can create a feedback loop, amplifying market movements. However, this collective psyche can lead to amplified risk, where the unfounded optimism of one day may transform into panic the next. Understanding these emotional and psychological factors is vital for anyone looking to navigate the rollercoaster that is the stock market.

Long-Term vs. Short-Term Gains

While many investors are currently fixated on short-term fluctuations in volatility, it’s important to consider the long-term perspective. Those investing in ETPs should weigh the potential for future returns against the realities of market behavior today. Historically, patience has often paid off for investors who remain committed to a more strategic approach.

Conclusion

As investors pour into exchange-traded products targeting volatility, they’re not just placing bets on a market rebound; they’re participating in a complex interplay of factors significantly impacting their returns. Understanding these complexities—from the quirks of contango to market sentiment—can help investors navigate the choppy waters of volatility more effectively. While the pursuit of high returns is tempting, a well-rounded approach to investment, focused on transparency and education, ultimately leads to more sustainable success.