Meta Platforms Inc.’s Record-Breaking Corporate Bond Sale

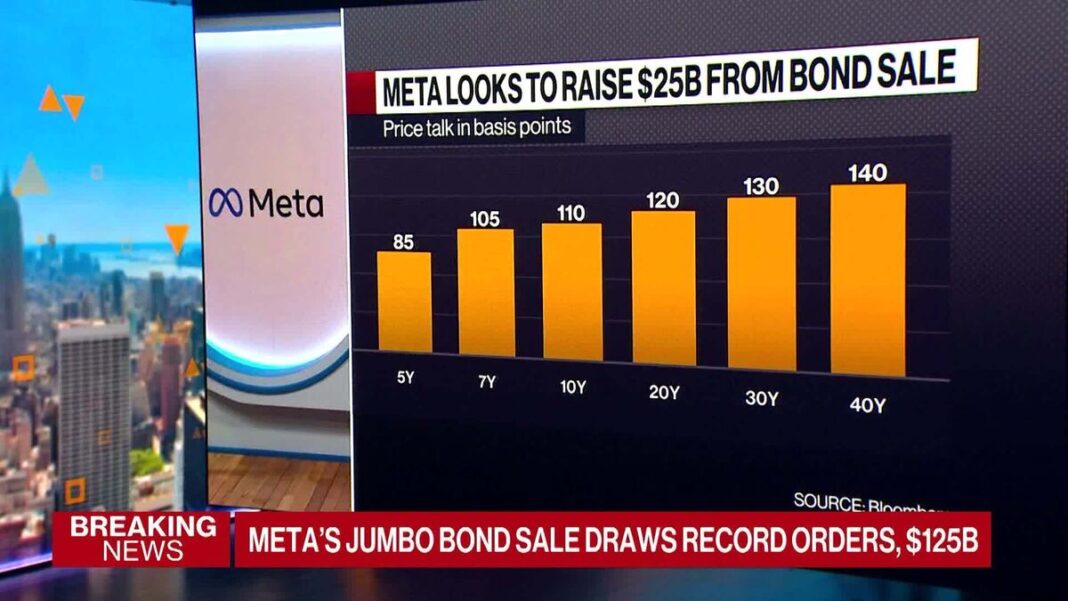

Meta Platforms Inc., the parent company of Facebook, Instagram, and WhatsApp, has just achieved a remarkable milestone in the financial world. The tech giant has secured an unprecedented $125 billion in orders for its corporate bond sale, which is garnering significant attention across various sectors. This incredible level of interest reflects not only the confidence investors have in Meta but also the shifting landscape of corporate financing.

Context of the Bond Sale

Corporate bonds are debt securities issued by companies to raise capital. By selling these bonds, companies can fund operations, invest in new projects, or even refinance existing debt. Meta’s decision to issue bonds comes as it looks to strengthen its financial position and support ambitious growth plans amid a rapidly changing technology landscape.

This specific bond offering is aimed at reshaping Meta’s financing strategy, particularly as it seeks to invest heavily in areas like the metaverse, artificial intelligence, and augmented reality. With these forward-thinking investments, the company is positioning itself to be a leader in the next generation of technology.

Unprecedented Demand

The astonishing demand for Meta’s bond offering signifies a robust appetite for corporate debt among investors. $125 billion in orders represents the highest amount ever recorded for a corporate bond sale, breaking previous records and highlighting the strong confidence investors have in the stability and growth potential of Meta.

Several factors contribute to this demand. For one, Meta has a track record of strong financial performance and a dominant position in the social media space. Additionally, the current low interest rate environment makes corporate bonds an attractive investment option. Investors are keen to tap into the return potential that such securities offer, especially when traditional safe-haven investments, like government bonds, yield lower returns.

Implications of the Bond Sale

The successful execution of this bond sale could have far-reaching implications not just for Meta but for the broader tech industry. With such a significant influx of capital, Meta could accelerate its development plans and potentially set a precedent for other tech firms aiming to raise funds through similar mechanisms. This could initiate a trend where tech companies lean more on bond markets rather than equity offerings to secure funding, thus reshaping capital-raising strategies in the sector.

Investor Sentiment

Investor sentiment around the bond sale is overwhelmingly positive. Analysts suggest that the funding will enable Meta to tackle pressing challenges, including competition from other social media platforms, regulatory scrutiny, and the need to innovate in a fast-paced tech environment. Positive sentiment towards Meta’s long-term vision, particularly its investment in virtual and augmented realities, sparks a belief among investors that the company could yield significant returns from its initiatives.

Broader Market Impact

The impact of Meta’s record-breaking bond sale extends beyond the company itself. It serves as a barometer for investor sentiment in the corporate bond market. An influx of capital in this segment could lead to a ripple effect, encouraging other corporations, especially in the tech sector, to explore similar funding avenues. If this trend continues, we could witness an evolution in how companies approach financing, potentially favoring the bond market over traditional stock offerings.

Conclusion Within the Industry’s Evolution

As Meta Platforms Inc. embarks on this new financial venture, it underscores the importance of adaptability in the tech industry. The ability to secure substantial funding through corporate bonds may provide companies with the needed flexibility to navigate challenges and seize opportunities in an ever-evolving market. The success of this bond sale not only sets a record but also highlights a critical moment in how tech companies approach financing in an increasingly complex environment.