Saudi Arabia’s Bond Market: A Shift in 2026?

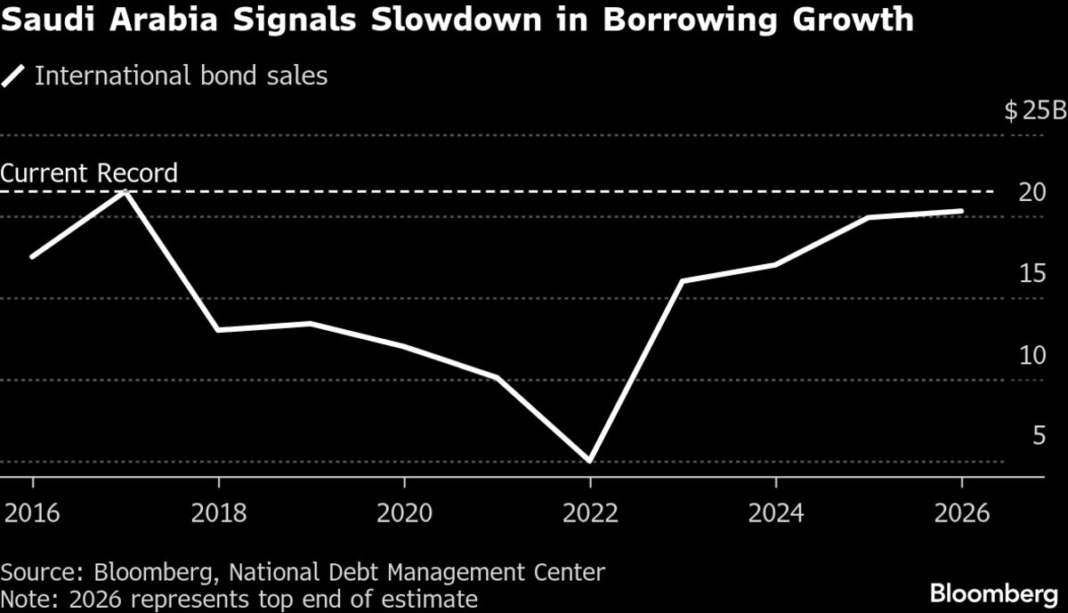

In recent years, Saudi Arabia has emerged as a significant player in the international bond market, capturing the attention of investors worldwide. The kingdom, buoyed by its Vision 2030 initiative, has leveraged global borrowing to fund various ambitious projects aimed at diversifying its economy away from oil dependency. However, forecasts for 2026 suggest a notable shift, with expectations of stable to lower international bond sales. This potential halt in escalating borrowing activities could indicate a new phase in Saudi Arabia’s fiscal strategy.

The Rise of Sovereign Bond Issuance

From 2016 onwards, Saudi Arabia’s bond issuance doubled, with the kingdom becoming one of the most active sovereign issuers in the emerging market landscape. The initial surge was primarily a response to falling oil prices, which significantly impacted government revenues. By tapping into international capital markets, Saudi Arabia sought to finance its budget deficits and fund pivotal infrastructure and social projects. The kingdom attracted substantial interest from global investors due to its relatively robust credit ratings and the promise of reform.

Driven by Vision 2030 Initiatives

Vision 2030, launched by Crown Prince Mohammed bin Salman, is a strategic framework aimed at transforming the Saudi economy. One of the vision’s core tenets is to reduce reliance on oil and diversify economic activities. This ambitious plan has required significant funding, leading to increased bond issuance. Projects in tourism, entertainment, and technology have significantly benefited from international capital, and bond sales have played a crucial role in realizing these initiatives.

Market Dynamics and Investor Sentiment

While Saudi Arabia’s bond market flourished, it also reflected the dynamics of global investor sentiment. As interest rates fluctuate and economic conditions shift worldwide, the attractiveness of Saudi bonds is susceptible to change. Increasing geopolitical tensions and concerns regarding regional stability could affect investor appetite. Furthermore, with a global focus on sustainability and green financing, there is a growing demand for bonds that align with environmental, social, and governance (ESG) criteria. In this context, Saudi Arabia faces the challenge of evolving its bond offerings to maintain competitiveness.

The Road Ahead: A Possible Halt?

Looking toward 2026, forecasts of stable to lower bond sales suggest a cautious approach from the Saudi government. Analysts predict that the government may prioritize fiscal discipline, leading to reduced borrowing. This potential shift could indicate a strategic pivot, as the kingdom might seek to manage its existing debt more prudently while carefully evaluating new financing needs.

Policy Changes and Economic Indicators

Several economic indicators will likely influence Saudi Arabia’s bond market trajectory. If oil prices stabilize at favorable levels, this could provide the kingdom with increased revenues, reducing the immediate need for additional borrowing. Similarly, successful implementation of Vision 2030 projects might improve economic resilience, giving policymakers room to recalibrate their fiscal strategies. Any shifts in U.S. monetary policy, especially concerning interest rates, will also bear significant implications for Saudi bond sales.

Investor Outlook: Caution Amidst Optimism

Investor outlook toward Saudi Arabia’s bonds remains mixed. While many see potential for long-term growth, concerns about short-term volatility persist. The kingdom’s strategic economic reforms and diversification efforts offer promise, but uncertainties in the global economy create a cautious backdrop. Investors will be closely monitoring any signals from the Saudi government regarding fiscal policies and future bond issuance plans.

Conclusion: Embracing Change in the Bond Landscape

As Saudi Arabia navigates this transitional phase, the bond market will undoubtedly remain a barometer of broader economic trends. The potential stabilization or reduction in bond sales could signify a mature economy adapting to new realities. Understanding these dynamics is essential for investors and policymakers alike, as the kingdom continues its journey towards a more diversified and resilient economic future.