Understanding Currency Hedging in Taiwan’s Life Insurance Sector

In recent months, Taiwan’s life insurance sector has been feeling the pressure of fluctuating currency values. The local currency, the New Taiwan Dollar (TWD), has experienced significant ups and downs, prompting insurers to consider increasing their currency hedging strategies. This proactive measure aims to safeguard overseas assets and maximize returns amidst turbulent market conditions.

The Current State of Currency Hedging

Taiwanese insurers are currently operating at near record low levels of currency hedging. This cautious approach has been shaped by a combination of strategies and market conditions over the past few years. The insurance industry has traditionally maintained a balanced hedging strategy to protect against currency risks; however, recent economic uncertainties are driving a shift towards greater currency protection.

Why the Shift in Strategy?

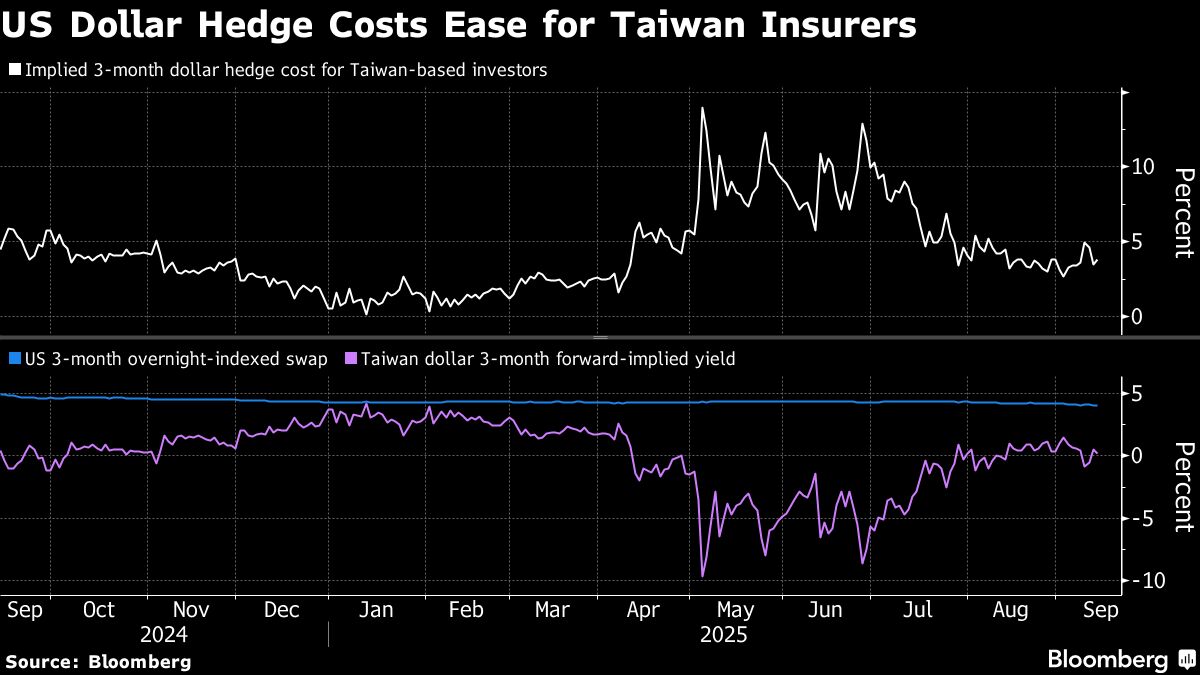

The decision to bolster currency hedging stems from the consistent volatility of the TWD against major currencies like the US dollar and the euro. This volatility poses risks not just to financial stability but also to long-term investment strategies for insurers. As many life insurers have substantial investments in foreign markets, fluctuations in the currency can significantly impact their returns. Thus, enhancing hedging efforts has become a necessary response to ensure asset stability.

Impact of Global Economic Conditions

The current global economic environment additionally plays a crucial role in this evaluation. Economic recovery challenges, interest rate hikes, and geopolitical tensions contribute to uncertainty in foreign exchange markets. Taiwanese life insurers are increasingly wary of how these factors may affect their international portfolios. As a result, the focus is shifting toward more robust hedging strategies to navigate these turbulent waters effectively.

Tools and Techniques for Hedging

Life insurers utilize various financial instruments for currency hedging. Popular methods include forward contracts, options, and swaps. Forward contracts allow insurers to lock in exchange rates for future transactions, offering protection against unfavorable moves. Options provide the flexibility to convert currencies at a predetermined rate, safeguarding against declines without limiting the potential upside. Swaps can also be employed for longer-term exposure management, helping insurers realign their currency positions more dynamically.

The Balance Between Risk and Return

While increasing hedging activities can mitigate risks, it also introduces new challenges. A heavier reliance on these financial instruments may lead to increased costs for insurers, impacting overall profitability. Furthermore, if the currency stabilizes or moves favorably, overly aggressive hedging might lead to missed opportunities. Insurers must carefully balance these factors, weighing the cost of hedging against the potential risks that currency fluctuations pose to their investments.

Regulatory Considerations

In addition to market dynamics, regulatory frameworks are an essential factor in determining hedging strategies. Taiwan’s Financial Supervisory Commission (FSC) has set rules that govern how insurers must handle their foreign currency exposure. These regulations aim to ensure that insurers maintain sufficient capital reserves while managing risks effectively. As the FSC increases scrutiny on how life insurers approach currency risks, strategic adaptations will be essential.

A Look at Future Trends

As we look ahead, the trend toward enhanced currency hedging in Taiwan is expected to continue. With ongoing economic uncertainties both domestically and globally, life insurers are likely to remain vigilant. Innovations in financial products and a deeper understanding of market dynamics will play crucial roles in refining these strategies over time.

Conclusion

Taiwan’s life insurance sector is on the brink of a significant pivot in its approach to currency hedging. By navigating the complexities of market volatility and employing a proactive approach, these insurers are not just shielding their overseas assets but are also positioning themselves for long-term success in an ever-changing economic landscape.