Foreign Insurers and U.S. Assets: A Renewed Strategy

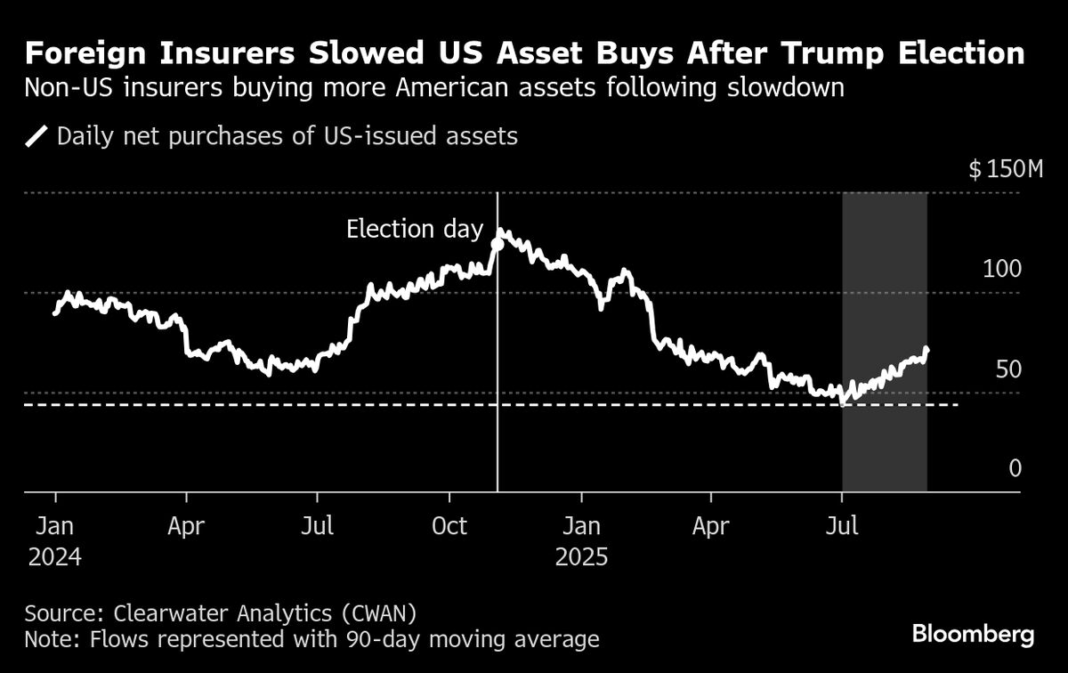

In recent months, a significant trend has emerged in the realm of international finance: foreign insurers are once again ramping up their acquisitions of U.S. assets. This resurgence follows a noticeable slowdown during the early part of President Donald Trump’s second term, reflecting a dynamic interplay of global economic conditions and strategic investment decisions. Let’s explore the factors at play and what this means for both foreign insurers and the U.S. financial landscape.

The Cyclical Nature of Investment

International investment flows are often cyclical, influenced by various economic indicators, geopolitical events, and policy shifts. After a period of heightened uncertainty during the initial months of the Trump administration, during which foreign insurers cautiousized their investments, the market has stabilized. Improved economic forecasts, combined with a favorable interest rate environment, have encouraged insurers to re-enter the U.S. asset market.

This cyclical trend showcases the inherent ebb and flow of investor confidence. As foreign insurers recalibrate their strategies, they signal their renewed faith in the U.S. economy’s growth potential. This confidence is bolstered by the robust performance of American corporations, which, coupled with a relatively stable regulatory environment, creates an attractive investment backdrop.

Factors Driving Renewed Interest

Several factors have contributed to this renewed interest in U.S. assets by foreign insurers. Among them, the recovery of the U.S. economy following the initial disruptions caused by the COVID-19 pandemic has been pivotal. As businesses adapt and grow, foreign investors are keen to seize opportunities in a market that shows resilience and potential for return on investment.

Moreover, the relatively high yields offered by U.S. government bonds compared to those offered in other developed markets remain tempting for foreign insurers seeking to diversify their portfolios. These investments help insurers manage risks more effectively, offering a hedge against domestic volatility.

Changes in Regulatory Climate

The regulatory environment is another critical aspect influencing foreign investments. During Trump’s presidency, policies aimed at protecting U.S. interests while fostering foreign investments have seen various iterations. In recent months, there has been a shift towards providing more clarity and stability, allowing foreign insurers to navigate the landscape with renewed confidence.

This more predictable regulatory framework enables foreign entities to make informed decisions without the fear of abrupt legal changes that could impact their investments. The clarity surrounding trade agreements and foreign ownership frameworks has opened doors that many insurers were hesitant to engage with earlier.

Competitive Landscape

As foreign insurers return to the U.S. asset market, they find themselves navigating an increasingly competitive landscape. Domestic players have also been bolstering their positions, creating a robust environment where both foreign and local entities vie for the best opportunities. This competition benefits the overall market by fostering innovation and enhancing service offerings.

Furthermore, the interplay between foreign and domestic insurers can lead to collaborative efforts. Partnerships and joint ventures between international firms and local insurers can create synergies that enhance product offerings and expand market reach, leading to mutual growth.

Economic Implications

The influx of foreign investments into U.S. assets carries significant economic implications. Increased foreign capital can stimulate job creation and support local businesses, contributing to economic growth. Moreover, it reflects a vote of confidence in the U.S. market, which can encourage other investors—both domestic and international—to follow suit.

However, this trend also raises questions regarding market vulnerability and dependence on foreign financing. A volatile global economic environment could, in theory, lead to sudden withdrawals of foreign capital, impacting liquidity and stability in certain sectors. As such, stakeholders must balance the benefits of foreign investment with the associated risks.

Looking Forward

As foreign insurers continue to make inroads into the U.S. asset market, their strategies will likely evolve. They will need to remain responsive to changes in economic conditions, regulatory environments, and competitive dynamics. Attention to technological advancements and the increasing importance of sustainable investment strategies will also play a crucial role.

It will be fascinating to observe how these factors interact in shaping the future landscape of foreign investments in U.S. assets. The commitment of foreign insurers to engage with the U.S. market signals not only optimism but also a strategic recognition of the opportunities that lie ahead.