A Surge in Venezuelan Bonds: What It Means for Creditors

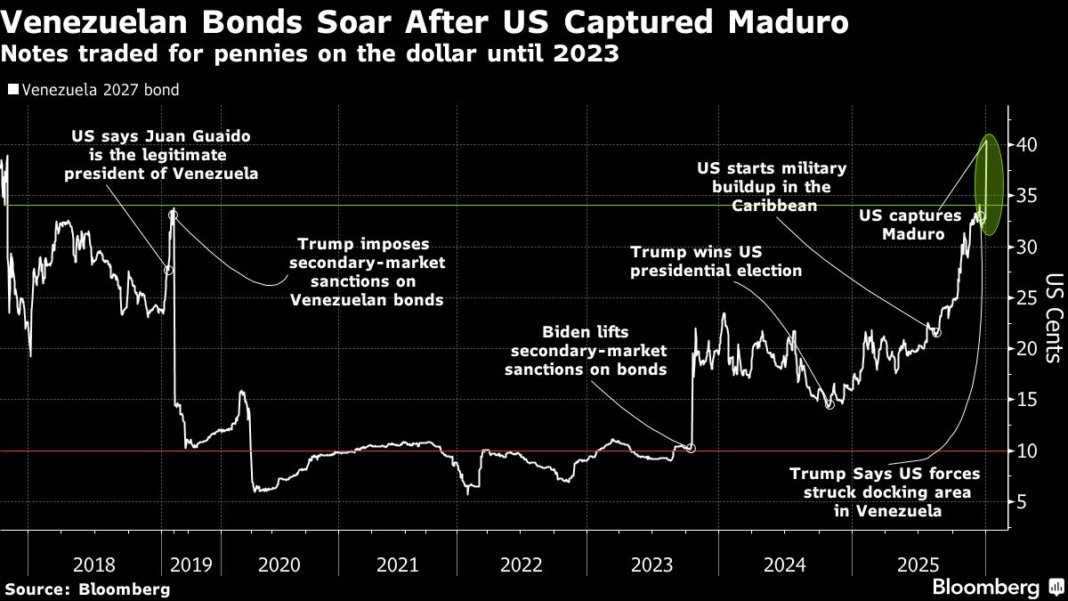

On a day marked by significant financial fluctuations, prices on Venezuelan bonds surged dramatically. This unexpected turn of events has captured the attention of investors and economists alike, stirring discussions about the potential implications for bonds linked to the nation deeply embroiled in economic turmoil. As creditors engaged in a crucial meeting, they contemplated how the recent U.S. political developments, particularly the ouster of President Nicolás Maduro, might impact their chances of reclaiming some of the approximately $60 billion in defaulted debt.

Understanding Venezuela’s Economic Context

To grasp the magnitude of this situation, it’s essential to understand Venezuela’s economic backdrop. Once one of the wealthiest countries in South America, Venezuela’s economy has been crippled by years of mismanagement, corruption, and plummeting oil prices. The country has experienced hyperinflation, severe shortages of basic goods, and a massive emigration crisis. Amid this chaos, Venezuela defaulted on its international debt, leaving bondholders in a precarious position as they sought to understand their rights and potential paths to recovery.

The Role of International Creditors

The group of creditors now gathering to discuss their investment strategies isn’t just a random assortment of investors; they represent a lengthy history of lending and financing interests in Venezuela. From major international banks to hedge funds, these creditors have stakes in the Venezuelan economy that are unprecedented in scale. Their collective concern revolves around whether the change in leadership can facilitate restructuring negotiations or if it merely adds another layer of complexity to an already convoluted situation.

The Impact of Political Change

The recent removal of Nicolás Maduro by the U.S. government has raised questions about the political landscape in Venezuela. What does a regime change mean for the negotiation of debts? Will a new administration be more amenable to negotiating with creditors? These questions linger in the air as investors assess the risks and opportunities presented by a potentially shifting political tide. Analysts suggest that a new government might be more open to dialogues about restructuring or repayment, offering a glimmer of hope to creditors seeking recovery.

Bond Valuation and Market Dynamics

The bond market is notoriously sensitive to political changes, and the recent uptick in Venezuela’s bond prices reflects a renewed interest from investors who may believe that this political shift could provide a path for recovery. Higher bond prices typically indicate increased investor confidence, although this sentiment may also stem from speculative trading. Creditors are now weighing these factors as they consider the implications of their investments, often relying on extensive analyses and varied financial models to guide their decisions.

The Complexities of Debt Restructuring

Debt recovery in countries facing political upheaval is never straightforward. Creditors must navigate a maze of legal, financial, and political challenges to secure their interests. In Venezuela, existing laws create obstacles, as creditors must often contend with a government that has previously refused to honor its obligations. Additionally, potential sanctions from the U.S. complicate matters, as they may restrict access to financial systems, thereby impeding negotiation processes.

The Sentiment Among Creditors

During their recent gathering, creditors expressed a blend of cautious optimism and deep concern. On one hand, the prospect of a new government re-opened doors that had long been shut; on the other hand, they acknowledged the multitude of risks still looming. Questions of governance, economic stability, and the ability to implement reforms linger, leaving them to ponder each angle meticulously. The sentiment around a potential resolution is fraught with hope yet tempered with the realism of Venezuela’s troubled history.

The Path Forward

As these discussions continue, the eyes of international investors remain glued to Venezuela. While some believe that the surge in bond prices could signal the dawn of a recovery phase, others advocate for a more tempered view, emphasizing the unpredictability of both the political and economic landscape. Whatever the case, creditors are aware that their path forward will require patience, strategic thinking, and perhaps, a dose of good fortune as they navigate the complexities of Venezuela’s unfolding narrative.

In the coming months, the dynamics between creditors and the new political administration will undoubtedly evolve, revealing the intricate dance between economic recovery and political realities in a country that has faced more than its share of challenges.