The Bond Market’s Unusual Reaction to Federal Reserve Rate Cuts

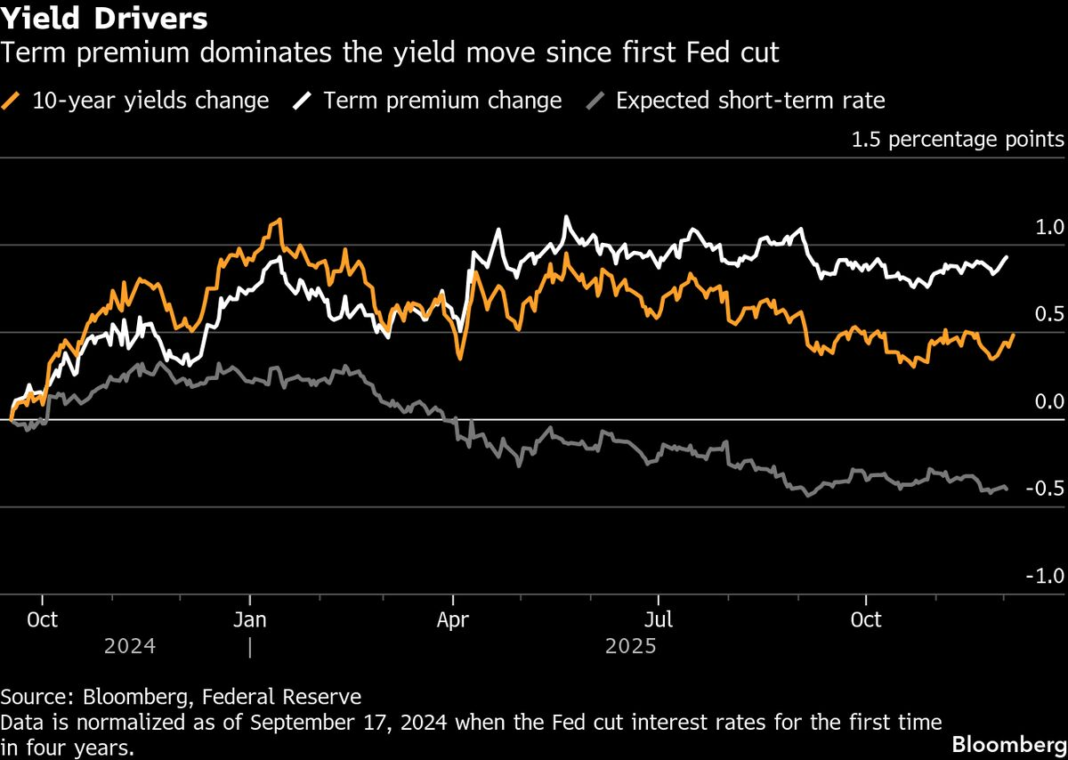

The bond market has long been viewed as a reliable indicator of investors’ expectations regarding the economy. Typically, when the Federal Reserve (the Fed) cuts interest rates, bond prices rise, and yields fall. However, recent developments have presented a puzzling scenario for many analysts and investors. In a notable departure from the norm, Treasury yields have climbed even as the Fed has implemented rate cuts. This unusual behavior has sparked significant debate and analysis on Wall Street.

Understanding the Basics: Interest Rates and Bond Yields

To contextualize this phenomenon, it’s essential to grasp the fundamentals. In general, bond prices and yields move inversely. When the Fed lowers interest rates, it often results in lower yields for newly issued bonds, making existing bonds with higher rates more attractive, which drives up their prices. Thus, yields should decrease. However, what we’ve witnessed recently is a notable spike in Treasury yields despite rate cuts—an event that bears resemblance to market dynamics not seen since the 1990s.

The Current Landscape of Rate Cuts

The Federal Reserve has been active in adjusting interest rates in response to changing economic conditions, especially in light of inflationary pressures. While the Fed’s intention is to stimulate growth and encourage borrowing by lowering rates, the market response has been contradictory, raising questions about investor sentiment and market expectations.

Analyzing Investor Sentiment

One contributing factor to this disconnect is investor sentiment. While rate cuts are meant to signal a supportive environment for economic expansion, many investors may perceive these actions as a sign of underlying economic weakness. The fear is that the Fed is forced to cut rates due to slowing growth or persistent inflation, leading to a lack of confidence in the economic outlook. As a result, investors may demand higher yields as compensation for the perceived risks associated with bonds, pushing yields higher instead of lower.

The Role of Inflation Expectations

Inflation expectations play a critical role in shaping market dynamics. In an environment where the Fed is cutting rates, one might expect inflation to fall; however, persistent inflationary pressures can create tension. If investors expect inflation to outpace the benefits of lower rates, they may adjust their required yield upward, further adding to the disconnect. Wall Street analysts are keeping a close eye on inflation data, which has shown signs of persistence, complicating the bond market’s reaction.

Market Technicals and Bond Selling

Another layer in this complex narrative is the technical aspect of bond trading. The bond market can be influenced by various technical factors, such as market liquidity, supply and demand dynamics, and positioning. Following rate cuts, some investors may choose to sell off bonds, believing they can achieve better returns elsewhere, which pushes yields higher. The market’s technical picture becomes crucial during such periods of Fed intervention, complicating the straightforward expectation of falling yields post-rate cuts.

Historical Context: Lessons from the 1990s

To better understand this peculiar behavior, it’s insightful to look at past instances. The 1990s presented a comparable scenario when the relationship between rates and yields deviated from the norm. During that time, economic shifts, changes in investor behavior, and varying inflation expectations resulted in unusual market responses. Drawing parallels between now and then can provide valuable insights but reminds us that markets are often influenced by a mix of economic conditions, psychological factors, and unexpected global events.

The Broader Economic Implications

The implications of this bond market reaction extend beyond bond traders and investors. Higher Treasury yields can affect mortgage rates, corporate borrowing costs, and consumer spending. If borrowing becomes more expensive for businesses and consumers, it could stymie economic growth, countermanding the Fed’s intent with rate cuts. This ripple effect highlights the interconnectedness of financial markets and the economy, demonstrating how unexpected reactions can shape a broader landscape.

Conclusion

The bond market’s unusual response to the Federal Reserve’s interest-rate cuts has added a layer of complexity to market dynamics and investor strategies. As Wall Street grapples with these developments, understanding the underlying factors contributing to this disconnect will be crucial for navigating an increasingly unpredictable economic landscape. Analysts and investors will undoubtedly continue to monitor this situation closely as it evolves.