The Rise of Stablecoins: Transforming Payments in the Modern Economy

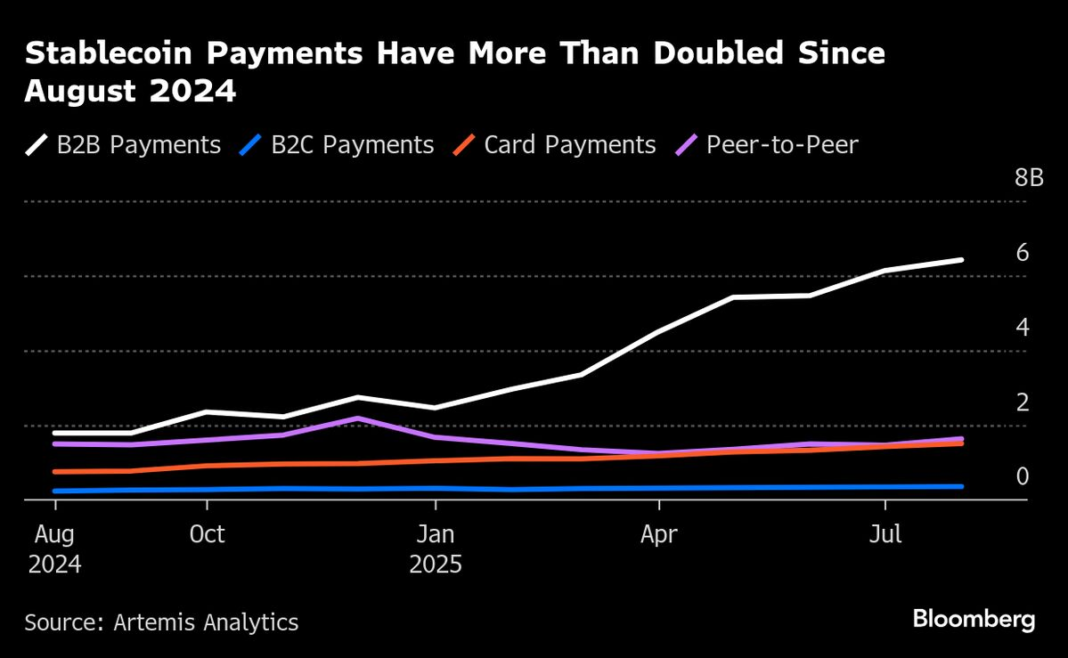

With the ever-evolving landscape of finance, a significant shift has emerged in the way consumers and businesses approach payments. The surge in the use of stablecoins—digital tokens pegged to traditional currencies such as the dollar—marks a pivotal change. This trend accelerated following the passage of the first U.S. legislation aimed at regulating this segment of the cryptocurrency market in July. Here’s a closer look at what stablecoins are, their benefits, and how they are reshaping transactions in our daily lives.

Understanding Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value by being pegged to a reserve of assets, typically fiat currencies like the U.S. dollar. Unlike their more volatile counterparts, such as Bitcoin or Ethereum, stablecoins are built to provide stability, making them an appealing option for both investors and consumers. This stability is achieved through various mechanisms, including collateralization with fiat, cryptocurrencies, or commodities. As a result, stablecoins combine the benefits of digital currency—like speed and accessibility—with the reliability of traditional money.

Legislative Momentum

The introduction of regulatory frameworks has played a significant role in the recent uptick in stablecoin usage. With the passing of new legislation, businesses and consumers can now make transactions with a clearer understanding of the legal landscape surrounding these digital assets. This regulation provides a sense of security and legitimacy, encouraging more stakeholders to incorporate stablecoins into their daily financial activities. The legislative clarity has also spurred innovation within the sector, prompting financial institutions and startups to develop new products and services that leverage stablecoins.

Real-World Applications

Stablecoins have begun to penetrate various aspects of commerce, from retail purchases to international remittances. In the retail space, businesses are increasingly accepting stablecoins as a method of payment, offering customers a seamless and fast transaction experience. For instance, a coffee shop might allow customers to pay for their morning brew using a stablecoin, providing an alternative to traditional cash or credit cards.

Internationally, stablecoins are proving particularly beneficial for remittances. Traditionally, sending money across borders involves significant fees and delays. However, stablecoins can facilitate instant transactions with minimal costs, making them an attractive option for migrant workers sending money back home. This aspect not only expedites payments but also democratizes access to financial systems for people in underbanked regions.

Advantages for Businesses

For businesses, the adoption of stablecoins presents numerous advantages. Transactions using stablecoins can be faster than traditional banking methods, especially for cross-border payments. This speed can translate to improved cash flow, which is crucial for small and medium-sized enterprises. Additionally, businesses can avoid the high fees typically associated with credit and debit card transactions by opting for stablecoins.

Moreover, stablecoins offer businesses a hedge against inflation and volatility. In regions experiencing economic instability, the ability to conduct transactions in a stable digital currency can protect businesses from currency depreciation, thus ensuring more predictable financial planning.

Consumer Adoption and Awareness

The increasing acceptance of stablecoins hinges not just on businesses but also on consumer awareness and adoption. Education around cryptocurrencies has been growing, with more individuals becoming familiar with how digital currencies work. The ease of access provided by mobile wallets and crypto exchanges makes it simpler for consumers to acquire and use stablecoins for everyday purchases. As awareness continues to spread, we can expect to see a surge in stablecoin transactions across various sectors.

Future Prospects

Looking ahead, the prospects for stablecoins appear bright. As technology continues to advance, it’s likely that stablecoins will evolve further, integrating with emerging technologies like blockchain and smart contracts. This evolution could lead to even more efficient payment solutions and broaden their applications across industries.

In addition, as more regulatory frameworks are established, we may see a rise in collaboration between traditional financial institutions and stablecoin issuers. Such partnerships could foster innovation and provide consumers with even more reliable and secure payment methods.

Final Thoughts

The landscape of payment processing is changing rapidly, with stablecoins at the forefront of this transformation. As regulatory clarity continues to develop and consumers embrace these digital tokens, stablecoins may soon become a mainstay in the way we conduct transactions—bridging the gap between traditional finance and the digital world.